How Guided Wealth Management can Save You Time, Stress, and Money.

How Guided Wealth Management can Save You Time, Stress, and Money.

Blog Article

Our Guided Wealth Management Statements

Table of ContentsAll About Guided Wealth ManagementThe Single Strategy To Use For Guided Wealth ManagementThe Only Guide to Guided Wealth ManagementUnknown Facts About Guided Wealth ManagementAll About Guided Wealth Management

Here are 4 things to take into consideration and ask on your own when figuring out whether you must touch the experience of a financial consultant. Your total assets is not your earnings, but instead a quantity that can help you understand what cash you earn, exactly how much you save, and where you invest cash, also.Possessions include investments and checking account, while responsibilities consist of charge card expenses and home loan settlements. Obviously, a positive total assets is much much better than an adverse total assets. Trying to find some instructions as you're assessing your financial circumstance? The Consumer Financial Security Bureau offers an on the internet quiz that helps gauge your financial wellness.

It's worth keeping in mind that you do not need to be rich to look for advice from an economic advisor. A significant life change or choice will certainly set off the choice to search for and hire an economic advisor.

These and various other significant life occasions may motivate the demand to go to with an economic advisor concerning your investments, your economic goals, and various other financial issues (financial advisers brisbane). Allow's claim your mother left you a clean sum of cash in her will.

More About Guided Wealth Management

In general, a financial advisor holds a bachelor's level in an area like money, bookkeeping or service monitoring. It's likewise worth absolutely nothing that you could see an expert on a single basis, or job with them more routinely.

Any person can say they're a financial expert, however a consultant with professional designations is preferably the one you need to hire. In 2021, an estimated 330,300 Americans worked as individual monetary experts, according to the United state Bureau of Labor Stats (BLS).

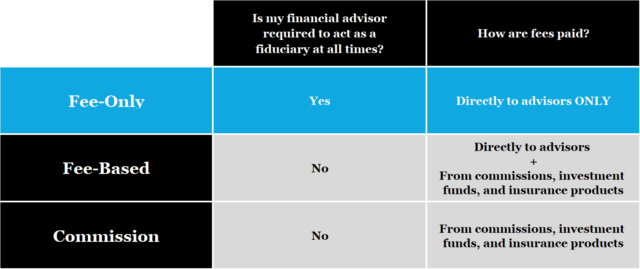

Unlike a signed up representative, is a fiduciary who have to act in a customer's finest interest. Depending on the value of possessions being managed by a signed up financial investment consultant, either the SEC or a state securities regulatory authority manages them.

Some Known Questions About Guided Wealth Management.

As a whole, though, financial preparation specialists aren't overseen by a solitary regulator. An accountant can be thought about a financial coordinator; they're regulated by the state bookkeeping board where they exercise.

Offerings can consist of retirement, estate and tax obligation planning, in addition to financial investment management. Riches supervisors usually are registered agents, indicating they're managed by the SEC, FINRA and state safeties regulatory authorities. A robo-advisor (financial advice brisbane) is an automatic online financial investment supervisor that depends on formulas to look after a client's properties. Clients usually don't obtain any human-supplied monetary suggestions from a robo-advisor service.

They make money by charging a cost for each profession, a flat monthly fee or a portion fee based upon the buck amount of properties being taken care of. Capitalists trying to find the best consultant must ask a number of questions, including: A financial consultant that deals with you will likely not coincide as an economic consultant useful content that works with an additional.

The Only Guide to Guided Wealth Management

This will certainly determine what type of professional is ideal suited to your demands. It is additionally essential to understand any costs and commissions. Some advisors might profit from offering unnecessary products, while a fiduciary is legitimately needed to select financial investments with the client's demands in mind. Choosing whether you need an economic expert entails evaluating your financial circumstance, identifying which sort of economic expert you need and diving right into the history of any monetary consultant you're considering working with.

Allow's state you want to retire (wealth management brisbane) in 20 years or send your youngster to a private college in ten years. To achieve your goals, you may need a knowledgeable expert with the ideal licenses to assist make these plans a reality; this is where a financial expert can be found in. With each other, you and your consultant will cover many subjects, including the amount of money you must conserve, the sorts of accounts you require, the type of insurance policy you ought to have (including long-term treatment, term life, handicap, etc), and estate and tax planning.

Some Known Questions About Guided Wealth Management.

At this factor, you'll additionally let your expert understand your financial investment choices. The preliminary assessment may likewise include an evaluation of other economic administration subjects, such as insurance policy issues and your tax circumstance.

Report this page